IRS Income Withholding Table Federal Withholding Tables 2021 is the procedure needed by the United States government in which companies subtract tax obligations from their staff members payroll. Federal Withholding Tables.

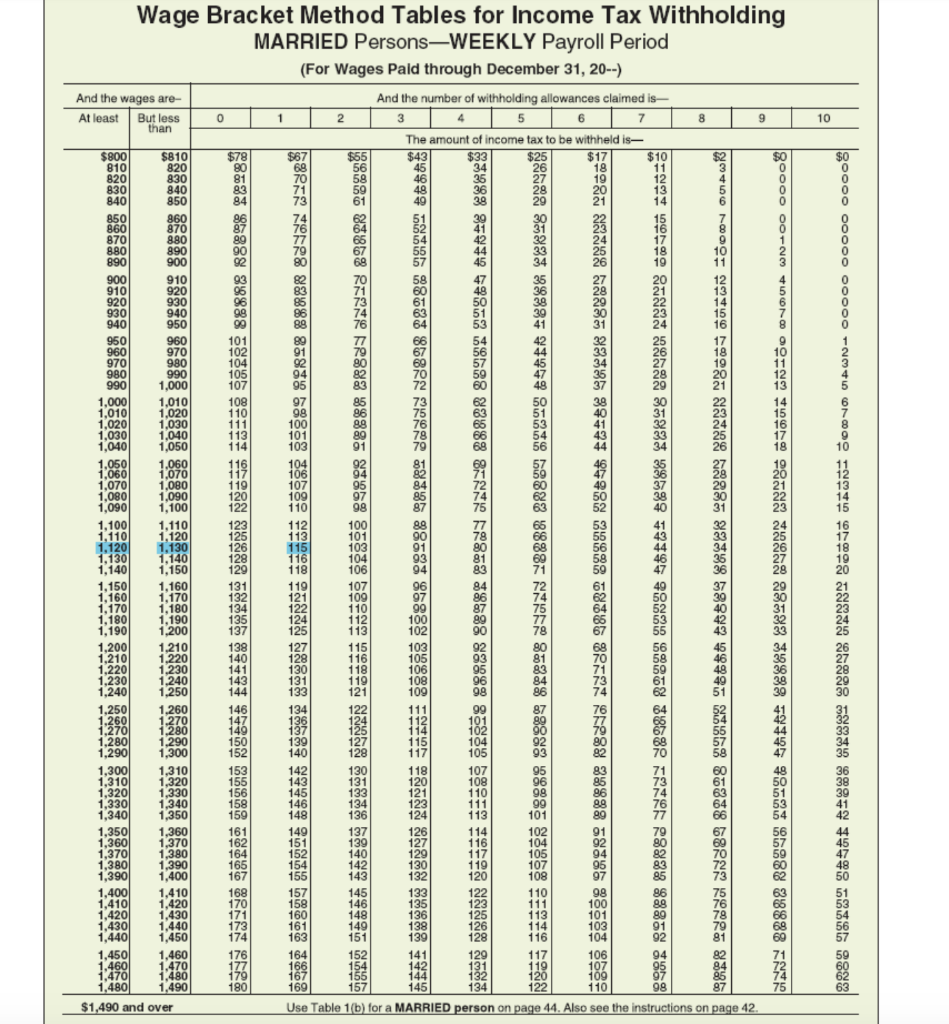

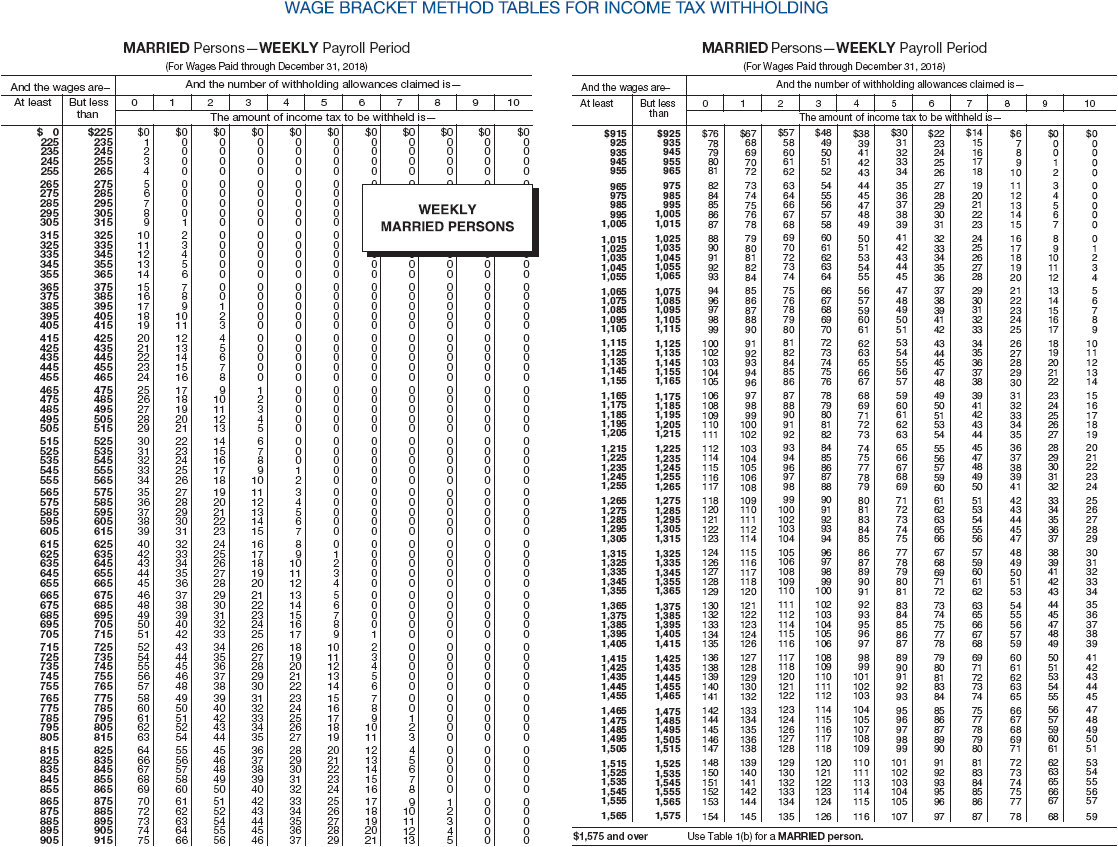

Federal Wage Bracket Method Tables 2021 Federal Withholding Tables 2021

By the amount of money being withheld the staff members have the ability to claim income tax return credit score.

Federal withholding tables. Federal Withholding Tables 2021 As with every other prior year the recently modified Employer Withholding Table was released by IRS to make for this years tax season. Employer Federal Tax Withholding Tables 2021 Publication 15-T is a supplement paper for Publication 15 of Overview for Employers Tax and also Agricultural Employers Tax. A federal withholding tax table is usually in the form of a table or chart to simplify this process for employers.

It provides several changes including the tax bracket changes and the tax price annually together with the option to employ a computational bridge. 2021 Wage Bracket Biweekly Federal Withholding Tables 2021 is the procedure called for by the US. July 31 2021.

Although this publication may be used in certain situa-tions to figure federal income tax withholding on supple-. IRS Tax Tables For Withholding 2021 The full instructions of Federal Income Tax Withholding are provided by the IRS Internal Revenue Service every year. By the quantity of cash being held back the employees have the ability to assert income tax return credit rating.

By Federal Withholding Tables. Federal Withholding Tables 2021 As with any other before year the freshly adjusted Standard Withholding Table 2021 was introduced by IRS to prepare with this years tax period. Federal Income Tax Withholding Tables 2021.

Federal Withholding Tables. The overview may be used by employers to compute the total amount of their employees withholding federal income tax from their salaries. Employer Federal Tax Withholding Tables 2021.

July 31 2021. It includes many changes including the tax bracket changes and the tax price annually together with the option to employ a computational bridge. This paper explains the process of determining withholding by utilizing the percent method or wage bracket method including tables that have been upgraded from the previous version.

It provides many changes such as the tax bracket changes and the tax price each year together with the option to employ a computational connection. Federal Withholding Tables 2021 As with any other prior year the recently modified Tax Withholding Chart was released by IRS to get ready for this particular years tax time of year. This year of 2021 is also not an exception.

This publication called Publication 15-T is utilized to declare the real difference in tax level and to supply employers the techniques to find out just how much wage they need to withhold from your workers. It provides several changes like the tax bracket changes and the tax level yearly along with the alternative to use a computational connection. July 31 2021.

Federal withholding tables dictate how much money an employer should withhold from their employees wages. The Tables for Withholding on Distributions of Indian Gam-ing Profits to Tribal Members. Federal Withholding Tables 2021 The IRS has just just recently released the freshly promoted Federal Income Tax Withholding Methods use in 2021.

By Federal Withholding Tables. By Federal Withholding Tables. Check out better to recognize just how the process functions formally.

Federal Withholding Tables 2021 As with any other before year the newly altered Federal Tax Withholding Allowance Chart was released by IRS to prepare for this years tax season. 15 of Guide for Employers Tax and Agricultural Employers Tax. The approaches of Federal Income Tax Withholding are mentioned under Publication 15-T.

By the amount of money being held back the staff members are able to claim income tax return credit score. Publication 15 Federal Tax Withholding Tables Federal Withholding Tables 2021 is the procedure called for by the United States federal government in which employers deduct taxes from their staff members payroll. This publication called Publication 15-T is utilized to declare the real difference in tax level and to provide employers the ways to figure out exactly how much wage they should withhold from the staff.

This year of 2021 is likewise not an exemption. You may also use the In-come Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax with-holding. This year of 2021 is likewise not an exemption.

This includes federal income tax Social Security and Medicare tax and sometimes state income tax as well. Federal Withholding Tables. Federal Withholding Tables 2021 Just like any other before year the freshly adjusted IRS 2021 Withholding Tables was released by IRS to get ready with this years tax season.

Biweekly Withholding Table 2021 The complete guidelines of Federal Income Tax Withholding are released by the IRS Internal Revenue Service each year. This publication referred to as Publication 15-T is utilized to announce the difference in tax rate and to offer employers the methods to find out how much wage they ought to withhold from your workers. Federal Withholding Tables 2021 The IRS recently just recently released the freshly promoted Federal Income Tax Withholding Methods utilization in 2021.

15-T is a supplement document for Pub. The guide might be used by companies to determine the overall of their workers withholding federal income tax from their incomes. Government in which employers subtract taxes from their workers payroll.

Read better to recognize just how the process functions formally. It includes many changes including the tax bracket changes and the tax rate annually together with the choice to utilize a computational link. IRS Tax Withholding Tables The complete guidelines of Federal Income Tax Withholding are provided by the IRS Internal Revenue Service yearly.

Federal Withholding Tables 2021 The IRS recently lately given the newly promoted Federal Income Tax Withholding Methods use within 2021.