The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes. Verified 1 week ago.

Fillable Form 1040 2018 Income Tax Return Irs Tax Forms Irs Taxes

2016 Earned Income Credit EIC Table - Taxesareeasy.

Eic table 2016. Publication 596 2020 Earned Income Credit Eic Internal Revenue Service. Follow the two steps below to find your credit. The EIC reduces the amount of taxes owed and may also give a refund.

Your 2015 maximum Earned Income Tax Credit amount varies based on the number of your qualifying children. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status. 2018 Earned Income Credit EIC Table Caution.

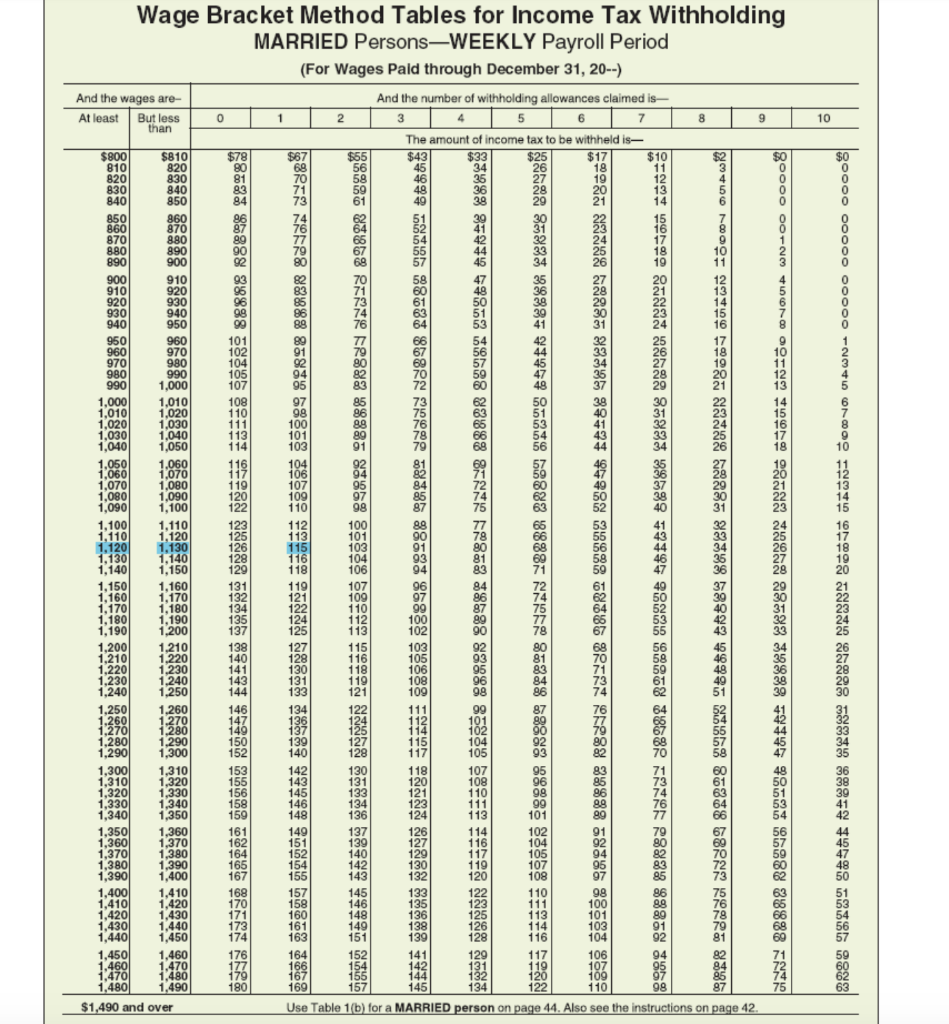

Read down the At leastBut less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet. Eic 2018 tax brackets irs chartlets are in fact a ready business alternative to desktop and laptop computers. The EIC on either your original or an amended 2016 return even if that child later gets an SSN.

Sierra Construction Company Concrete Contractor. Eic Table 2017 Wild Country Fine Arts. Irs Tax Tables 2018.

15173A Earned Income Credit EIC For use in preparing 2015 Returns Get forms and other information faster and. This is not a tax table. 2017 Eic Table Wild Country Fine Arts.

Indiana Earned Income Credit 2016 For use in preparing 2016 Returns DISCLAIMER. A married per-son filing a joint return may get more EIC than someone with the same income but a different filing status. Then go to the column that includes your filing status and the number of qualifying children you have.

Find Out If You Qualify. The maximum earned income credit allowedpayable for the given tax year is shown in line 1. This is not a tax table.

You can take them everywhere and even use them while on the go as long as you have a stable connection to the internet. How to read the EITC tables. 2017 1040ez Tax Form Pdf.

Mail your return to. Macgregor Associates Architects Structural Engineer. Earned Income Credit Table 2018 Earn Money 2020.

Complete the form s on Adobe Reader. Page 1 of 37 1446 - 6-Jan-2016 The type and rule above prints on all proofs including departmental reproduction proofs. Earned income credit 2020 chart.

Follow the two steps below to find your credit. This is not a tax tableFollow the two steps below to find your credit. MUST be removed before printing.

Free 2017 Printable Tax Forms. Look up the amount on line 5 above in the EIC Table on pages 62-70 to find your credit. Enter No directly to the right of Form 1040 line 66a Form 1040A line 38a or Form 1040EZ Line 8a.

Sierra Construction Company. 2 Exhibit 8 10 2018 Earned Income Credit Table No Chegg Com. Indiana Earned Income Credit in a Nutshell First you must meet all the rules in this column.

IDS Real Estate Group Clarion Partners Architectural Firm. Read down the At leastBut less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet earlier. Enter the credit here.

Print it out and sign it at the bottom of page 2. Increased EIC on certain joint returns. 2016 EIC FINALISTS WWWBUILDWITHSTRENGTHCOM.

2016 Earned Income Credit EIC Table CAUTION. If line 6 is zero stop. The credit maxes out at 3 or more dependents.

Second you must meet all. This is not a tax table. Therefore the signNow web application is a must-have for completing and signing 2019 eic table chart on the go.

2016 Earned Income Credit EIC Table. 44450 if you have two or more qualifying childrenEarned income credit eic eic table chart 2017 the future the ins and outs of earned income earned income tax credits. Publication 596 2020 Earned Income Credit Eic Internal Revenue Service.

Read down the At leastBut less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet earlier. 2017 Eic Table Wild Country Fine Arts. Attach any tax documents ie.

The Ins And Outs Of Earned Income Tax Credit For 2018 Harik Thompson Cpas. Enter your AGI or Form 1040EZ line 4 8300 if you do not have a qualifying. As a re-sult the EIC table.

Find and download Form 1040 Schedule EIC Earned Income Tax Credit and other 2016 tax forms. 2016 Earned Income Credit EIC Table CAUTION. To find your credit read down the At least But less than columns and find the line that includes the amount you were told to look up from your EIC Worksheet.

Tax Brackets Deductions Alternative Minimum Eitc Capital And Financial Services Inc. This publication is intended to provide nontechnical assistance to the general. 2019 Earned Income Credit - 50 wide brackets 61219 If the If the If the amount you And you listed-- amount you And you listed-- amount you And you listed--2019 Earned Income Credit - 50 wide brackets 61219 At But less Your credit is-- At But less Your credit is-- At But less Your credit is--.

Here is the most current EIC Earned Income Credit Table. 2015 eic table. W-2 1099-MISC etc to your return.

Department of the Treasury Internal Revenue Service Publication 596 Cat. 2017 1040 Tax Form Pdf. You can reference IRS publication 596 or use online tax providers like TurboTax or HR Block to get a free estimate of the specific credit amount you would get.

The tax table identifies the current tax year 2019s maximum credit amounts and earned income limits per qualifying child. Updated Below are the final IRS published 2016 and 2017 Earned Income Tax credit EITC figures. 2016 Earned Income Credit EIC Table CAUTION.

You cannot take the credit. Earned Income Credit 2016 SCHEDULE EIC Qualifying Child Information 43 Child 1 Child 2 Child 3 1 Childs name 2 Childs SSN 3 Childs year of birth 4 a b 5 Childs relationship to you 6 Number of months child lived with you in the United States during 2016 Qualifying Child Information Form 1040A or 1040 Yes. 2016 Earned Income Credit EIC Table CAUTION.

5 Stryker Business Center Phase 2 Kent WA Owner Developer.